In the start-up world, time is money – the faster a business can get things moving, the easier it is for the business to gain momentum, growth, and be sustainable for the long run. Local grants help Singapore businesses access sources of capital quickly to set up and expand their business.

In an interview with local news channel, Channel News Asia, Mr Chia Yoong Hui, chief executive officer of local SME, Ascenz, shared that the grants spared them the challenge of having to look for collaterals and assets early on in the business.

“Our company is more research-based, and most of our assets are our intellectual properties. It’s harder to get bank loans based on that, and grants provide us with a feasible alternative to fund our research and development efforts,” he said.

Explaining Government Grants for SMEs

In budget 2018, Singapore's government introduced three grants to help growing businesses. These grants combine existing grants to streamline the entire process for businesses. SMEs that require funding to grow should consider the Productivity Solutions Grant and Enterprise Development Grant which will provide businesses with funding to modernise, expand and partner with other businesses.

Productivity Solutions Grant

The Productivity Solutions Grant (PSG) is designed to give SMEs the financial capability to adopt new technologies and productivity solutions. Beginning in April 2018, the PSG program will organise existing grants to provide a seamless process for small businesses.

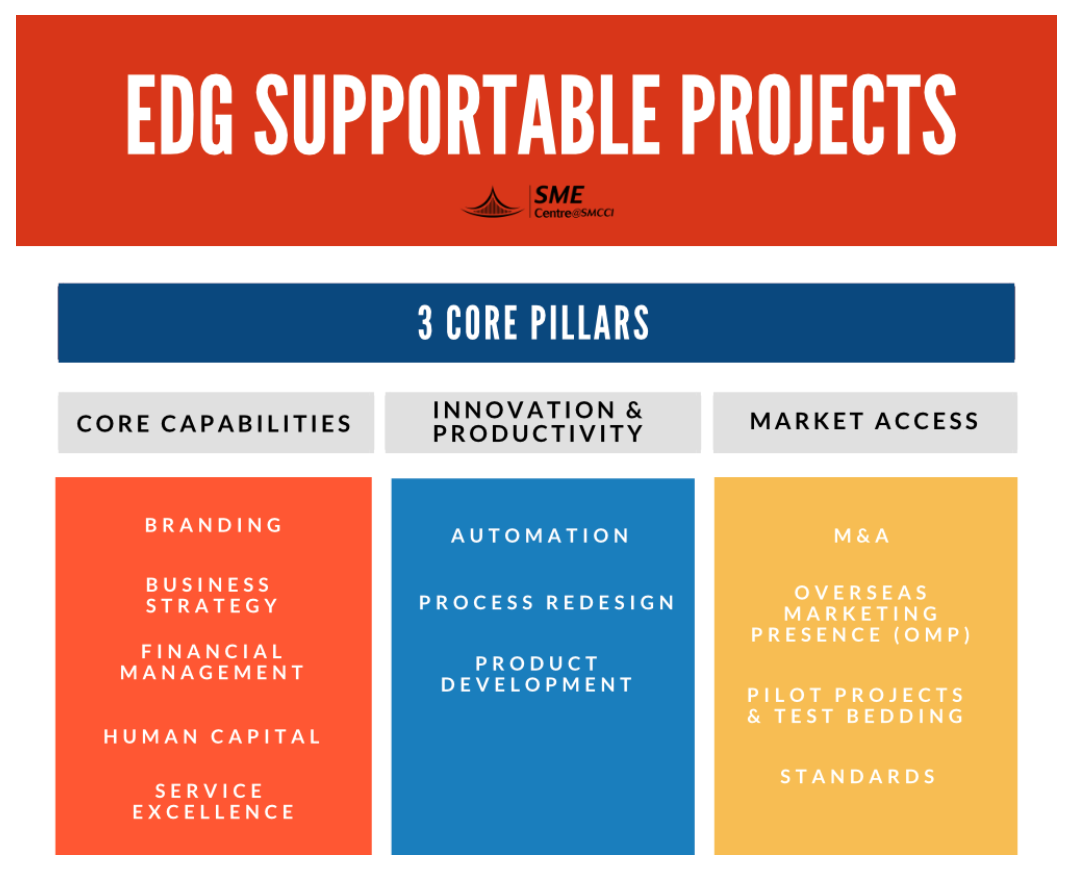

Enterprise Development Grant

The Enterprise Development Grant (EDG) allows businesses to develop, grow and expand internationally. These grants will cover up to 70% of the costs of qualifying activities and are offered through Enterprise Singapore. These grants are ideal for larger SMEs that have plans to grow their business overseas.

Parting Thoughts & Alternatives

Singapore's 2018 budget reorganised existing grants to streamline the funding process. SMEs that plan to upgrade their technological capabilities expand internationally or partner with other businesses may be able to subsidise their costs through one of these three grant programs. SMEs that do not qualify for these grants or have specific financing needs should consider one of the many other financing options available to Singaporean small businesses, such as debt or equity funding from banks, venture capital firms and online crowd-funding platforms.